Flooding from torrential rains recently led Vermonters to kayak through the streets of the state capital. A month later, Hawaiians were forced to flee to the ocean to avoid devastating blazes. All the while, toxic smoke from wildfires has imperiled the health of Americans across huge swaths of the country. All these alarming environmental developments hurt economic activity. Yet many political leaders seem preoccupied with banning investors from considering the impacts of the fast-changing environment on business.

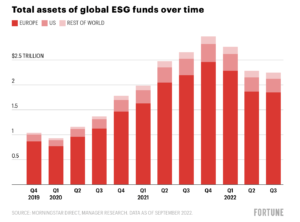

These fervent objections to the longstanding use of environmental, social, and governance (ESG) criteria in investing are a recent political chimera emanating — at least in part — from the overselling of an ill-defined concept. ESG investors include nonfinancial factors in their decisions to buy or sell a security or private asset. ESG does not, however, prevent them or anybody else from purchasing the stocks of fossil fuel companies, nor does it contribute essential primary capital to develop solutions to avoid the worst impacts of climate change.

These fervent objections to the longstanding use of environmental, social, and governance (ESG) criteria in investing are a recent political chimera emanating — at least in part — from the overselling of an ill-defined concept. ESG investors include nonfinancial factors in their decisions to buy or sell a security or private asset. ESG does not, however, prevent them or anybody else from purchasing the stocks of fossil fuel companies, nor does it contribute essential primary capital to develop solutions to avoid the worst impacts of climate change.

https://www.institutionalinvestor.com/article/2c3comfbca055bi96zxts/opinion/proponents-and-critics-of-esg-claim-it-can-change-society-both-will-be-disappointed

Most people assume that ESG Investing is designed to reward companies that are helping the planet. In fact, ESG ratings which underlie ESG fund selection are based on “single materiality” — the impact of the changing world on a company P&L, not the reverse. Asset management firms have been happy to let the confusion go uncorrected — ESG funds are highly popular and come with higher management fees. The danger with ESG investing is that it might convince policy makers that the market can solve major societal challenges such as climate change — when in fact only government intervention can help the planet avoid a climate catastrophe

Most people assume that ESG Investing is designed to reward companies that are helping the planet. In fact, ESG ratings which underlie ESG fund selection are based on “single materiality” — the impact of the changing world on a company P&L, not the reverse. Asset management firms have been happy to let the confusion go uncorrected — ESG funds are highly popular and come with higher management fees. The danger with ESG investing is that it might convince policy makers that the market can solve major societal challenges such as climate change — when in fact only government intervention can help the planet avoid a climate catastrophe We talk with Ken Pucker, Advisory Director at Berkshire Partners and a Senior Lecturer at the Fletcher School at Tufts University.

We talk with Ken Pucker, Advisory Director at Berkshire Partners and a Senior Lecturer at the Fletcher School at Tufts University. Managers of ESG investments create false hope, exaggerate outperformance, and contribute to the delay of long-past-due regulatory action.

Managers of ESG investments create false hope, exaggerate outperformance, and contribute to the delay of long-past-due regulatory action.