Join us for a frank discussion on ESG, climate investing, and the need for government policy through taxes and subsidies to push companies into doing the right thing for the climate crisis. As our guest Ken Pucker, former COO of Timberland, says, ESG has no impact on saving the planet. Ken talks about the challenges for all of us in understanding when and where real Capital is invested in impacting climate change. Ken argues that better accounting on externalities alone is not enough. We need to price externalities to drive real behaviour change. Hence, the role of government policy is to play a role with taxation and subsidies to reward good behaviour and punish bad. A Podcast by Tec Sounds.

-

-

A Realist’s Guide to Investing for Good

https://ssir.org/articles/entry/a_realists_guide_to_investing_for_good

“How would you suggest that I invest my savings of ten thousand dollars to have a positive social and environmental impact?”

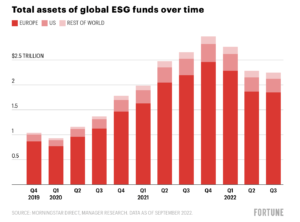

The question came from a PhD student this time, but we get it a lot. Many people want their money to work for them—to preserve their financial security and to improve the world. In fact, almost 85 percent of individual investors say they are interested in sustainable investing and more than three quarters believe they can use their investments to influence the extent of climate change. In response, asset managers have created and rebranded trillions of dollars of funds as ESG (environment, social, and governance) funds targeting socially minded investors. So, it should be easy to recommend many worthy qualifying investments. Right?

-

Proponents and Critics of ESG Claim It Can Change Society. Both Will Be Disappointed

Flooding from torrential rains recently led Vermonters to kayak through the streets of the state capital. A month later, Hawaiians were forced to flee to the ocean to avoid devastating blazes. All the while, toxic smoke from wildfires has imperiled the health of Americans across huge swaths of the country. All these alarming environmental developments hurt economic activity. Yet many political leaders seem preoccupied with banning investors from considering the impacts of the fast-changing environment on business.

These fervent objections to the longstanding use of environmental, social, and governance (ESG) criteria in investing are a recent political chimera emanating — at least in part — from the overselling of an ill-defined concept. ESG investors include nonfinancial factors in their decisions to buy or sell a security or private asset. ESG does not, however, prevent them or anybody else from purchasing the stocks of fossil fuel companies, nor does it contribute essential primary capital to develop solutions to avoid the worst impacts of climate change.

These fervent objections to the longstanding use of environmental, social, and governance (ESG) criteria in investing are a recent political chimera emanating — at least in part — from the overselling of an ill-defined concept. ESG investors include nonfinancial factors in their decisions to buy or sell a security or private asset. ESG does not, however, prevent them or anybody else from purchasing the stocks of fossil fuel companies, nor does it contribute essential primary capital to develop solutions to avoid the worst impacts of climate change.https://www.institutionalinvestor.com/article/2c3comfbca055bi96zxts/opinion/proponents-and-critics-of-esg-claim-it-can-change-society-both-will-be-disappointed

-

Shuffling deckchairs on the Titanic: is ESG a redundant concept?

Institutions across the globe have welcomed the ISSB’s much-anticipated inaugural global sustainability standards. However, some industry experts warn that too much focus on standardising data could distract from the urgent need to decarbonise.

https://www.energymonitor.ai/finance/reporting-and-disclosure/is-esg-investing-a-redundant-concept/

-

33. Is ESG investing good for biodiversity?

ESG is the latest buzzword in business & biodiversity circles, but it’s not actually new – only newly popular. And it’s one among many terms and acronyms in this field, which may be familiar but are often poorly understood – ESG stands for “environmental, social and governance” investing criteria. Understanding concepts like ESG is consequential because their success relies largely on convincing the general public of their value and their virtue. As we discuss in this episode, however, they are not necessarily all that they’re made out to be.

To elucidate this topic with me is Ken Pucker. Ken is a professor at the Fletcher School at Tufts University and Advisory Director at the Boston-based Financial Services firm, Berkshire Partners. He was previously Chief Operating Officer of the outdoor footwear and apparel company, Timberland, one of the first companies to take an interest in sustainable production. He has written extensively on ESG and related issues in Harvard Business Review among other publications.

To elucidate this topic with me is Ken Pucker. Ken is a professor at the Fletcher School at Tufts University and Advisory Director at the Boston-based Financial Services firm, Berkshire Partners. He was previously Chief Operating Officer of the outdoor footwear and apparel company, Timberland, one of the first companies to take an interest in sustainable production. He has written extensively on ESG and related issues in Harvard Business Review among other publications.https://www.case4conservation.com/post/33-does-esg-help-biodiversity-ken-pucker

-

Important Problems with Andreas Feiner

In this episode we speak with Ken Pucker, who is an advisor at Berkshire Partners, lectures about sustainability at the TUFTS university.You will get interesting insights in his career at Timberland and the pioneer role that Timberland took in regards to ESG.Ken will tell you why he decided to leave Timberland in the end and go to live with his family in Jerusalem for a while.Nowadays, Ken is a Professor of Practice at TUFTS University, where he lectures on ESG-related topics such as ESG investments and why companies urgently need to take ESG matters into account in order to remain or become attractive for investors.

https://podcasts.apple.com/us/podcast/3-the-important-role-of-esg-for-companies-with/id1683622451?i=1000613984210

-

Climate Finance Groups Are Misunderstood, BMO Says

Climate finance groups that press companies to decarbonize are wrongly confused as being regulators that set rules for businesses to reach net zero emissions, according to Dan Barclay, chief executive officer of BMO Capital Markets.

https://www.bloomberg.com/news/articles/2023-04-25/climate-finance-groups-are-misunderstood-bmo-s-barclay-says?leadSource=uverify%20wall&sref=fnjoKOAK

-

Vanguard Confronts an Inconvenient Truth

Vanguard had previously joined the Net Zero Asset Manager’s initiative (NZAM) in 2021, but withdrew 21 months later, citing confusion about individual firms’ views. Vanguard is unique in its ownership structure, commitment to passive index-based low-fee funds, and focus on retail investors. It has taken a more cautious approach to ESG investing and doesn’t heavily rely on external ESG ratings services. Critics argue that Vanguard should compel companies to decarbonize to prevent portfolio losses, but this overlooks asset managers’ primary duty and overstates ESG investing’s impact. Vanguard believes that addressing climate change requires governmental action and that the industry should aggressively endorse this path. Regulatory changes clarifying sustainable investing and a bifurcation of ESG investing can enable more authentic decarbonization. Vanguard’s NZAM withdrawal acknowledges the limits of win-win ESG “solutions” and clarifies the path to urgent decarbonization.

https://hbr.org/2023/04/vanguard-confronts-an-inconvenient-truth?ab=hero-subleft-2

-

Sustainable Funds Face Big Challenges. Only Some Will Be Winners

“On a relative basis, flows to ESG funds remain healthy, as compared to traditional funds. So one could say that from the asset managers’ perspective, the ESG model isn’t broken. Actually, its proven very resilient,” says Pucker, who has written extensively on ESG investing. “From the perspective of the planet, ESG is almost irrelevant. And from the perspective of the individual or institutional investor who thinks they are getting either alpha impact, I would argue it is broken.”

https://www.barrons.com/articles/sustainable-funds-face-big-challenges-esg-winners-51672961981

-

ESG investing faces challenges from all sides. Can it survive?

The beleaguered environmental, social, and governance (ESG) investment sector has taken a pummeling from all sides this year, most recently from a Republican-led offensive accusing $8 trillion asset manager BlackRock and other investment companies of hostility toward the oil and gas sector.

https://fortune.com/2022/12/19/esg-investing-faces-challenges-from-all-sides-can-it-survive/