“How would you suggest that I invest my savings of ten thousand dollars to have a positive social and environmental impact?”

The question came from a PhD student this time, but we get it a lot. Many people want their money to work for them—to preserve their financial security and to improve the world. In fact, almost 85 percent of individual investors say they are interested in sustainable investing and more than three quarters believe they can use their investments to influence the extent of climate change. In response, asset managers have created and rebranded trillions of dollars of funds as ESG (environment, social, and governance) funds targeting socially minded investors. So, it should be easy to recommend many worthy qualifying investments. Right?

https://ssir.org/articles/entry/a_realists_guide_to_investing_for_good

On April 8, the National Oceanic and Atmospheric Administration observatory in Mauna Loa, Hawaii, reported that the carbon dioxide levels in the atmosphere had reached 419 parts per million, the highest levels recorded in more than 4 million years. That same day, BlackRock, the world’s largest asset manager, announced another milestone: It had raised

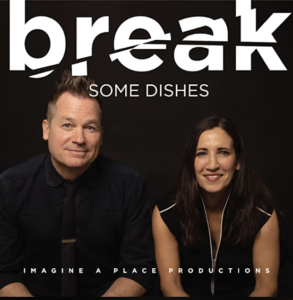

On April 8, the National Oceanic and Atmospheric Administration observatory in Mauna Loa, Hawaii, reported that the carbon dioxide levels in the atmosphere had reached 419 parts per million, the highest levels recorded in more than 4 million years. That same day, BlackRock, the world’s largest asset manager, announced another milestone: It had raised  re you familiar with sustainable finance? ESG investing? Impact accounting? No? That’s ok, neither were we – that is until we met Ken Pucker. Ken is the Advisory Director at Berkshire Partners and a Senior Lecturer at the Fletcher School at Tufts University – he is also the former COO of Timberland. In today’s episode, Ken helps pull back the curtain on sustainability reporting, the myth of sustainable fashion, and how accounts just might be the unlikely heroes in giving our world a fighting chance at a more sustainable future. Read more from Ken Pucker on HBR: https://hbr.org/search?term=kenneth%20p.%20pucker Break Some Dishes is an Imagine a Place Production, presented by OFS: https://ofs.com/imagine-a-place

re you familiar with sustainable finance? ESG investing? Impact accounting? No? That’s ok, neither were we – that is until we met Ken Pucker. Ken is the Advisory Director at Berkshire Partners and a Senior Lecturer at the Fletcher School at Tufts University – he is also the former COO of Timberland. In today’s episode, Ken helps pull back the curtain on sustainability reporting, the myth of sustainable fashion, and how accounts just might be the unlikely heroes in giving our world a fighting chance at a more sustainable future. Read more from Ken Pucker on HBR: https://hbr.org/search?term=kenneth%20p.%20pucker Break Some Dishes is an Imagine a Place Production, presented by OFS: https://ofs.com/imagine-a-place